Jeopardy winners and trading winners have a lot in common

I posted the below educational post yesterday, but wanted to give an update on the results from last nights show, and give weekend viewers a chance to do a little homework (it is a little longer than most posts).

James Holzhauer ran away from the competition once again. His total winnings are up t $771,920, after winning $74,133 in his last game. For 11 games his average is up to $70,174.54. That is up from the $69,778.70 yesterday. Of the 40 questions he answered yesterday, he got 0 wrong. His right to wrong totals are 381 right, and 13 wrong.

How long and high can he go?

Below is the post from yesterday. I hope you learn some things.

-----------------------------------------------------------------------------------------------------

Jeopardy! is a game show where three contestents compete in providing the question to answers under topic headings. Since you need to answer with a question, you need to form your response in the form of a question like "Who is Alex Trebek?" That would be in response to "He hosts the long running game show where contestants answer in the form of a question".

Another response, "Who is James Holzhauer?", would be the response to the answer "He is on pace to becoming the highest earner in Jeopardy! history". Get it?

The last 10 days on the show has seen a professional sports gambler named James Holzhauer race through the games without much competition. His 10 day total winnings are $697,787 or $69,778.70 per day. That pace is more than double the all-time record holders average. That record holder won 74 consecutive days and amassed $2.52M over that period. That comes to $32,054 per day

If Holzhauer were to go 74 days without losing, he would win $5.16M. Judging from his results to date, it may become his full time job for the entire year. He is without competition. No one is close.

The Game.

In Jeopardy!, the subject categories are broad in topic like "Shakespearean Plays".

They could also have clever/fun topics. For examples, a category heading might by "All my Ex-es", and the contestants will be instructed that all the answers start with letters "Ex".

There are categories that suit the contestants skill, and others that don't.

There are two rounds with round 1 having values for correct answers from $200 to $1000 or $15,000 of total potential winnings "on the board". Round 2 has values from $400 to $2000 or $24,000 in potential winnings..

If a contestant were to answer every question correctly, he would win $39,000. So how can Holzhauer haul in $69,778.70 per show?

Leverage.

The cumulative totals can be leveraged higher as there is one Double Jeopardy question in game one, and two Double Jeopardy questions in game 2 (three in total). Those questions allow the contestant - who is in charge of the board (i.e. answered the last question correctly) - to wager up to his current winnings. So if the contestant has $5000, he/she can in effect wager $5000 (and double his/her total). That's leverage.

The game ends with Final Jeopardy question - another leverage opportunity - where the contestants can wager all or part of their total winnings (again on a determined topic). All players answer the same question and bet whatever they want.

The winner is the one with the most money after Final Jeopardy.

The winning process

To win the game, you need to have a broad knowledge on many topics. You also need to be ready to press a button with your thumb on a hand held devise, as soon as Alex Trebek finishes reading the question, and do that ahead of the competition (i.e, you need to anticipate and react).

In effect the game process involves:

- Anticipating responses from the topic chosen,

- Reading the question,

- Listening to the question audibly,

- Processing the information quickly, and

- Anticipating with an action (press the button at the right time).

Before game requires:

- A plan on how to play the game

- Immense knowledge

- Practice. Practice. Practice.

Oh, you also have to hope you are right as a correct answer is rewarded with a dollar value, but a wrong answer leads to a negative value. The higher the value, the higher the dollar risk.

Finally, it does help to utilize leverage opportunities IF you have the skill.

Since getting hooked on the show this last week, I started to think if traders/trading relates to contestants/the Jeopardy! game?

The answer is a resounding "YES!"

Let's go through some key similariities from the two. Hopefully it will help you with the game of trading.

1. The Game Plan

In my book, Attacking Currency Trends, I outline a game plan for traders. That game plan is to trade trends and keep fear to a minimum.Trends are where the most money is made and lost. It is essential that you stay on the right side of a trend. Don't do it, and you lose money...fast. Look back on your biggest losses and I guarantee it was because you traded against the trend.

In Jeopardy!, the trend is "knocking it out of the park" in category topics that you know. I am not great in "Famous baroque composers" but "The Masters" (as in the golf tournament) or "Technical Analysis", would be topics I would ride the trend with lots of confidence.

What about fear?

In trading you define your risk, and limit your risk using technical tools. A trend line or 100 day MA are implicit "lines in the sand" that say bullish above, and bearish below. If you know that line is your risk line, and you look to limit your risk by trading near it, then do the final step of accepting the risk in your mind. Once you accept the risk, your fear should disappear.

Because you are doing that process, and your risk is limited, you have a greater chance to "make more than your risk". All of which, should lower your fear.

In Jeopardy!, the most successful players, like James, are defining, and limiting risk on each question read ("Do I answer it or not?"), and also accepting that risk every time the button is pressed (i.e. I am 80% sure but I accept that risk of loss).

A statistical fact from James Holzhauer's performance to date (CLICK HERE for interesting game facts and comparison to another super contestant), shows he has answered 341 questions correctly with 13 incorrect responses.

That is incredible win/loss percentage, and it does come with outright knowledge, but you can understand why he is so fearless. He has defined and limited his risk, and accepts the risk by pressing the button.

2. Knowledge

At Forexlive, we all try to teach, coach, and mentor, with not only timely information but trading knowledge.

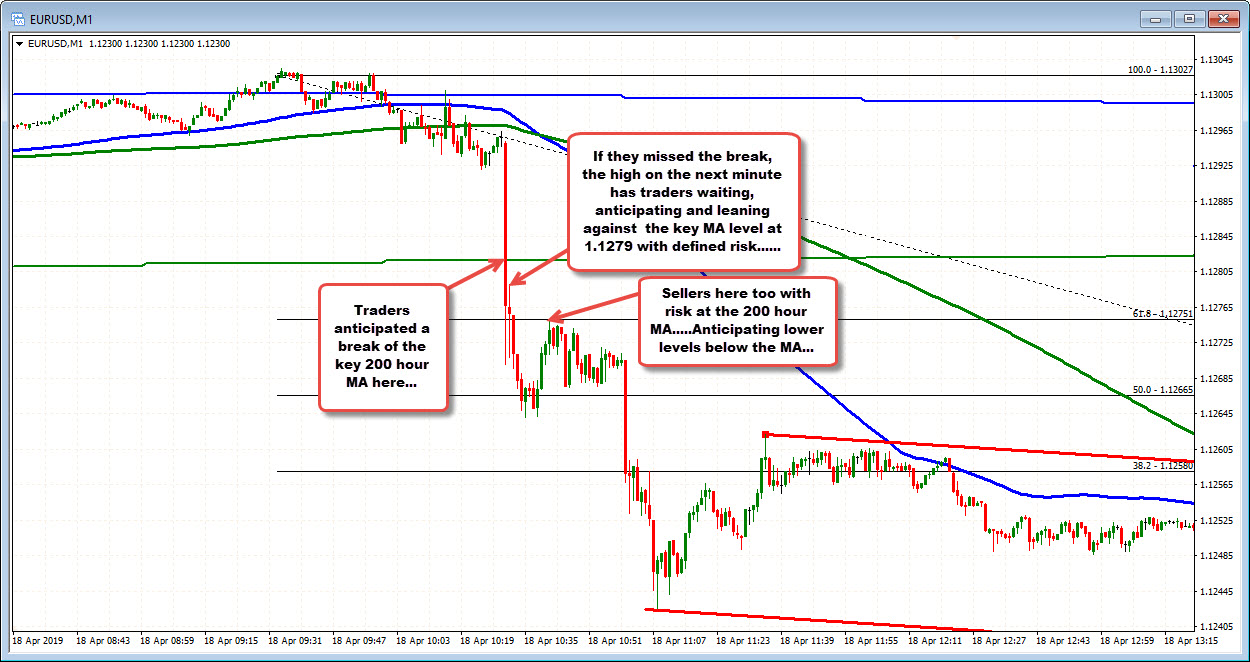

I could tell you to sell the EURUSD on a break of the 1.1282-84 area, but I also show you the chart that has the 200 hour MA and a swing area converged at that area. Hence a break would shift the bias to the downside. The price should go lower. I post everyday using the same tools and trading decisions. I wrote about the "yellow area" and the 200 hour MA many times.

One of the things that James Holzhauer said when asked how he prepared, was that he "studied topics that he was most uncomfortable with". He is already incredibly smart, but he had a desire to make himself better in things he was not good at.

He also said that there is a "limit to knowledge". You can't learn it all. There is information that borders on the absurd in knowing. For example, knowing all the Canadian birds in existence would be a waste of time, but knowing the Loon reside in every province and territory and is on the dollar coin, would be something too know, and a potential question (or answer).

In trading, if you know too much, you can lose track of the obvious. You need to know enough to win the game but not too much to border on the absurd.

Know what you need to know in trading to win the game, and know it well.

3. Practice. Practice. Practice.

In trading, the longer you do it, the better you become.- You learn that Friday's can be the worst of the times to trade, while Tuesday's to Thursday's can be great times.

- You learn to understand non-trending markets and how to trade them.

- You learn how to recognize and trade trending markets.

- You understand how to target and what reaching a target, allows you to do with your stop.

- You learn to respect failures.

- You learn when to trade bigger (leverage up) or when to trade smaller (or not at all).

Reading about winners on Jeopardy!, one of the consistent tips the best contestants shared is to go over the same things over and over and over again.

By doing this, in the heat of the games battle, it will allow your brain to read or hear the question, and go right to the possible answer(s).

It is not good enough to read Romeo and Juliet, it is good enough to know by repetition the families are the Montagues and the Capulets. It is not good enough to read Hamlet. It is better to know that Hamlet caused the deaths of Polonius, Laertes, Claudius, and two acquaintances of his from the University of Wittenberg, Rosencrantz and Guildenstern.

In trading, if you look at enough charts and are consistent in your approach, you can see things more clearly.

In Jeopardy!, if you know Presidents and State Capitals and Shakespeare, and the most famous movie lines, you see things more clearly as well.

Practice. Practice. Practice.

4. Anticipation.

In trading you need to anticipate.

In the hourly chart from above, it is easy to show - after the fact - what happened. However, the most successful traders were already anticipating the potential break before it happened in that chart, and were "buzzing in" with a trade as it is breaking the 200 hour MA, or looking to lean against the level on a bounce

In trading, if you don't have an idea what the future looks like before it happens, you will be reacting too late. You need to anticipate by being prepared on what to do.

Below is the minute chart of the price action from the EURUSD with the overlay of the 200 hour MA at 1.1282. The price fell below the 1.1282 level on the weaker PMI releases to 1.1271 and then bounced to 1.1279 before moving lower again.

Why do we see that specific price action?

Traders, who anticipated, were waiting to sell below the 1.1282 and/or willing to sell on the correction against the 1.1282 (i.e. at 1.1279). They were anticipating what might happen next after the break (with defined/limited risk too). If the price moved back above the 1.1282 (say to 1.1288 oor 1.1289), they would likely bail. The price never got there, and they rode the trade to the downside.

On Jeopardy!, the most succcessful contestants are already anticipating the answers under a topic. If it is Shakespeare, "Who is Rosencrantz and Guildenstern?" are right there in their brain. If they are Masters golf experts, they are anticipating Jack Nicklaus, Butler's Cabin, Pimento Cheese sandwiches, Bobby Jones, Magnolia Drive, Amen Corner, Verne Lundquist, bikini wax (if you know the Masters, you can understand each of those).

You need to anticipate.

5. Reading. Listening. Processing. Reacting.

In trading, you need to read (both fundamental information and charts). You need to listen to "the market" through the price action. You need to process, and finally you need to react.Admittedly, most traders out there don't have the real-time headline news, but all do have the ability to read about other news that potential could move the market (Brexit, US China trade relations, etc).

I read Forexlive, the first thing every morning. I read the WSJ and other news sites. I don't want to overload, but I need to read.

Being aware is part of being a successful trader. You need to read and understand.

If you don't have a real time feed for news (seconds and minutes do matter a lot of times but so does anticipation of price action), you always have the charts in real-time. Charts do tell a story that may be influenced by something fundamental that you don't even know about yet - or quite frankly don't even need to know. The price action will always fit the story in tomorrows paper (or on the internet). Believe me.

Successful traders read stuff. That can be fundamental or simply charts.

Successful traders also listen to 'the market' through the price action and tools. The price action - and tools applied to the price action - do not lie. If the price in the USDCHF is making new highs since March 2017, don't ask me "Is the USDCHF a sell?. You are not listening to "the market", but are instead listening to the devil in your mind saying "sell because it is high".

LISTEN to what is happening. If the story changes, the price action and tools will tell you. I promise.

Succcessful trader also process and react. Processing and reacting are what you need to do to trade. If you can't process and react, you are not going to trade.

The same is true for contestants on Jeopardy!. They need to read and listen to the question, process the answer and react, by pressing the button and answering in the form of a question.

Read. Listen. Process. React.

6. Leverage

The final thing I want to talk about is leverage. I am a little hesitant to list this as most of you are not at the point where "leveraging up" is a good idea. However, more experienced traders who have mastered all of the above, can successfully leverage positions.

- ONLY be with the trend.

- Occur when you already have great trade location (in profit) on an existing position

- Be accompanied by fundamental bias in the same direction

- Be relatively early in the trend (you don't want to leverage up after 800 pips)

- Be entered on a retracement against a KEY, KEY level, or on the break of a KEY, KEY level in the direction of the trend,

- Have risk that is well defined, and at such a key level that you are sure if breached, would send the price the other way.

- Be accepted firmly by you (no wishy washy).

- Game Plan

- Incredible knowledge

- He has practiced

- He anticipates

- He reads, listens, processes. and reacts.

So that allows him to leverage up.

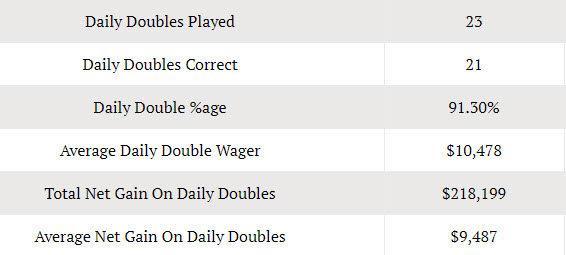

Below are his statistics from the Daily Doubles over the first 10 days:

A total of $218,199 of his $697,000 has come on Daily Doubles alone. That is leverage.

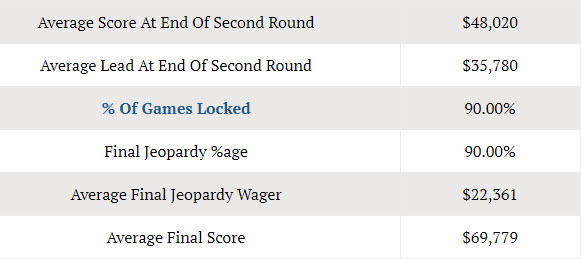

Those earnings have allowed him to have an average score at the end of the 2nd round $48,020 (remember there is only $39,000 on both Game 1 and Game 2 combined), and an average lead of $35,780.

His average wager on the Final Jeopardy question has been $22,361. By that time, he has locked up a win on 9 out the 10 shows.

Excessive leverage is earned on Jeopardy! and it is earned in trading too.

----------------------------------------------------------

Success in trading, and lots of other things in life - even Jeopardy! - have a lot of similarities in common.

As you progress as a trader, a good exercise is to read about experts in things other than trading, and try a see the similarities in each. You will find that you learn from them. That in turn will allow you to take the next step in your trading journey.

Wishing all a Happy Easter and Happy Pesach.

from Entertainment - Latest - Google News http://bit.ly/2KPy8zm

via IFTTT

April 19, 2019 at 11:48PM

Tidak ada komentar:

Posting Komentar